Why? It sounds like your assumption is economic warfare against the public, while my assumption is that markets drive rational behavior.

Rational behavior. Tear down a $2 million dollar house and replace it multiple million dollar apartments. Same plot of land, larger return. That's how real estate works. It's completely irrational to assume that developers will be unaware of the greater return if they choose that alternative. It's not economic warfare against the public. That's a silly perspective. The developers are operating within the private sector and their objective is maximum return for themselves by selling to the private sector. They have zero interest in losing money to benefit the public good. They're not in the housing welfare business. Losing money they don't have to lose is irrational behavior.

Your position is that everyone who can afford $1M to live can also afford $2M? Surely that can't be right.

My statement was that anyone who can afford the $2 million house can afford the $1 million apartment (you got it backwards). And, yes, that's right. Anyone who can afford $2 million for the house can afford $1 million for the apartment.

The goal of improving housing policy is to reduce housing-adjusted poverty (and generally raise living standards) and homelessness, and encourage more economic growth.

Yes but that is not the goal of real estate developers. You repeatedly conflate the two. You might use government to reduce zoning restrictions but, unless government is building the homes, it will be private sector developers who decide what gets built and at what price point. And, as rational actors, they will build what generates the greatest return for themselves.

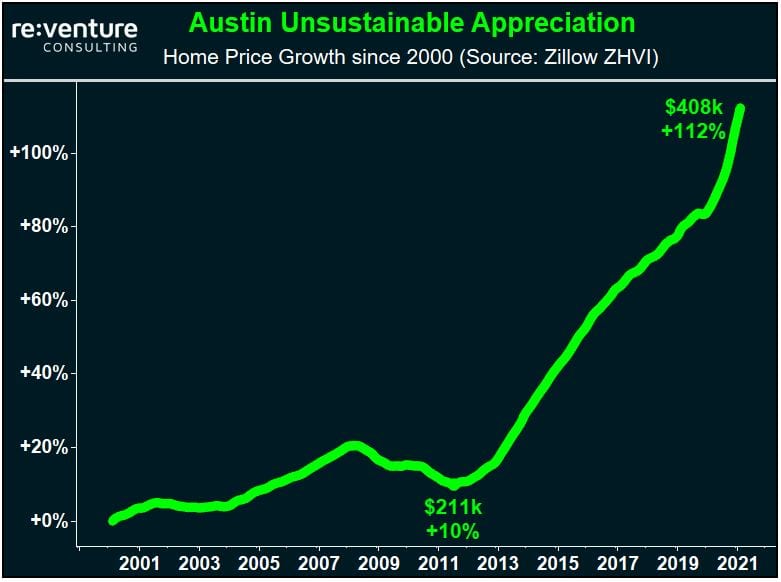

We're talking about the recent changes. There was a big influx of high-paying jobs, which by the logic of NIMBYs should have driven housing costs up, but they've actually come down (your graph cuts off the relevant time period).

You can pull the data yourself. I just posted the most visibly engaging graph. Housing prices didn't pull back until inflation hit the interest rates.

Do you think market logic is bound by geography?

No, but I know that real estate pressures are partially driven by cultural components so it makes little sense to introduce a community in Japan when the United States is what we're talking about and there are more than enough cities and towns to use for your examples.

"Affordable" is not a binary category. If we stop using policy to artificially drive housing costs up, they will come down. It's really odd to me that this isn't self-evident.

For someone who knows more about economics than most, your position here has a real blind spot. Probably because you don't really understand what drives the developers in the market. You seem to think that artificial restraints on housing supply only restrict the creation of affordable housing. Completely blind to the possibility that the restraints also restrict the creation of more high end housing.

Additionally, for prices to come down, supply must exceed demand. But there's absolutely nothing out there that suggests that the demand for high price housing has topped out or even remotely come close to exceeding the demand for such housing.

All. I'd really want to know what the justification for imposing scarcity is, actually.

But there isn't scarcity for "all". Weird. The only scarcity that exists in in "affordable" housing. And you seem to have no idea how developers work. Or an understanding that the type of housing you're asking for is economically unfeasible to construct.

I can't waste more time on this. I represent builders and developers from buyers flipping single family houses, converting them into duplexes or building multimillion dollar projects from the ground up. I own a real estate title company and I see what the developers are actually acquiring and what they intend to do with it. I negotiate the contracts and argue in front of the zoning boards, the license and inspection boards, etc. regularly. I get to sit in on the public policy meetings that push for affordable housing in my community (quietly and in the back of the room). And I get to sit in with the real estate community that genuinely lobbies for more affordable housing with real lobbyists, not just community organizers.

With all due respect, you don't understand this industry and surface level "If you just remove government, the private sector will build it" platitudes make that overwhelmingly clear. Every place understands that simply removing government restrictions on building will not result in more affordable housing. Every conversation is about how to incentivize the private sector to sink money into something that makes zero economic sense. But since you seem to think you know more than the people who are literally spending millions of their own dollars trying to accomplish the same goal, I'll leave you to it.