- Joined

- Mar 21, 2017

- Messages

- 686

- Reaction score

- 0

How The US Plans To Replace China As The World's Largest Manufacturer

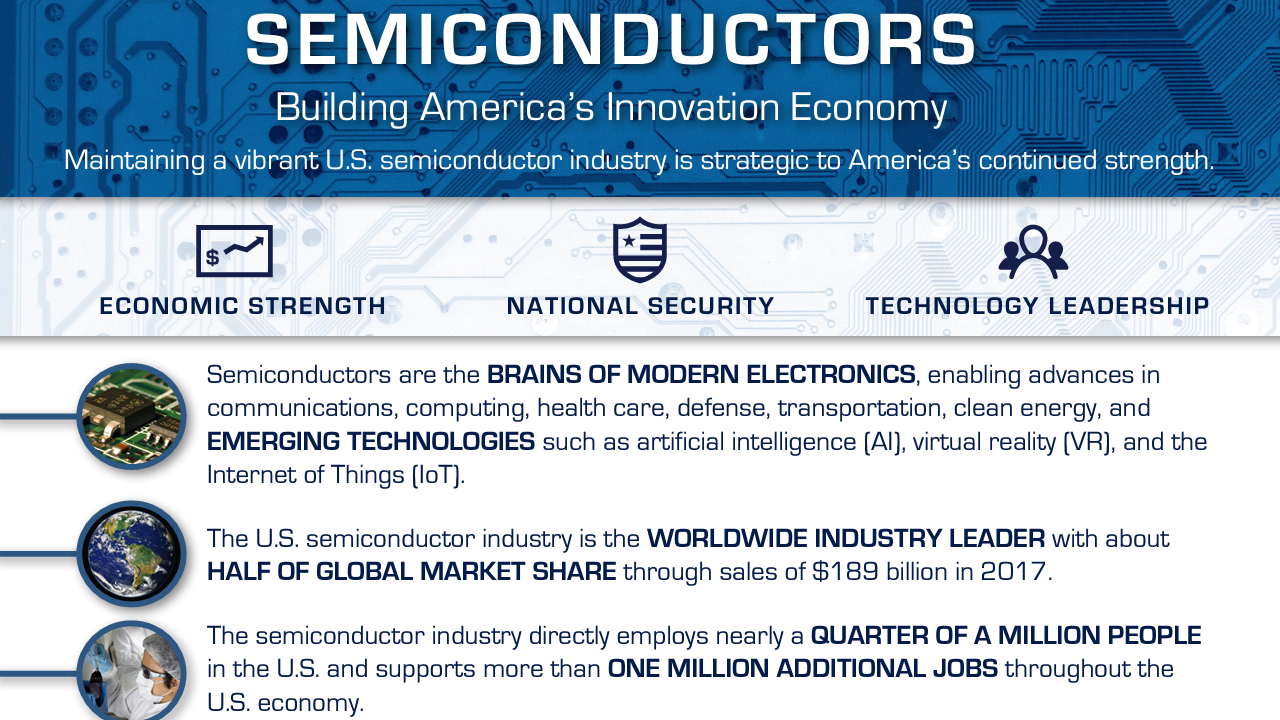

The United States, the world's second largest manufacturer with a 2017 industrial output reaching a record of approximately $2.2 trillion, will reportedly apply Industry 4.0 technologies to replace China as the world's largest manufacturer. This is what leading research firm Industry 4.0 Market Research reveals in its new report.

The report forecasts that the US Industry 4.0 market will grow at a CAGR of 12.9% during 2016-2023, in hopes of dominating the manufacturing race against China once again. China displaced the United States as the largest manufacturing country in 2010.

In the US, every dollar earned in manufacturing reportedly contributes $1.4 to the economy and for every manufacturing job created, approximately 2 jobs are created in other fields. Therefore, the US considers growth of the manufacturing sector a major success for the economy and is ready to invest considerable budgets to achieve it. It is understood that any efforts to reinvent US manufacturing by leveraging Industry 4.0 technologies to create smart factories will have a substantial impact on US economic growth.

Restoring manufacturing jobs to the United States struggling Rust Belt communities and corporate tax cuts were two of President Donald Trump's biggest campaign promises. It is expected that Trump's administration will follow Obama's Industry 4.0 policy (2011): the formation of the Advanced Manufacturing Partnership (AMP), a national effort bringing together industry and the federal government to invest in Industry 4.0 technologies.

The Industry 4.0 transformation holds immense potential. Smart factories allow individual customer requirements to be met, so that even one-off items can be manufactured profitably. In Industry 4.0, dynamic business and engineering processes enable last-minute changes to production and deliver the ability to respond flexibly to disruptions and failures on behalf of suppliers. With more efficient and optimized production in manufacturing, the entire sector is likely to thrive and rise again as a frontrunner of the US economy.

NOTE: The US 'Industrial Output' mentioned in the article doesn't take into account mining (oil and gas extraction) nor construction from what I can tell, which would actually bring the 2017 GDP output figure to around $3.65 trillion which is consistent with the CIA World Factbook.