Sears, the Original Everything Store, Files for Bankruptcy

By

Michael Corkery | Oct. 14, 2018

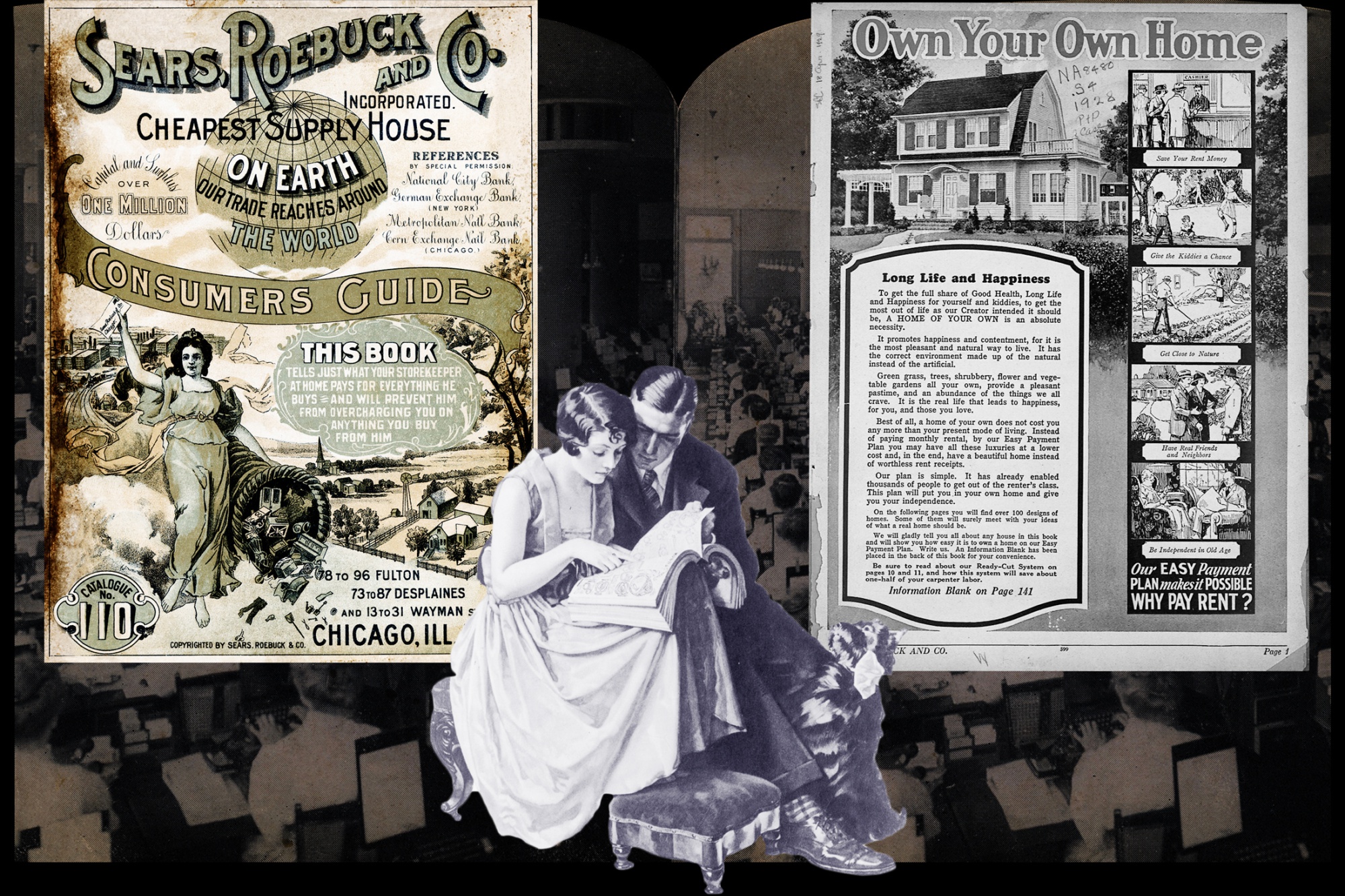

Founded after the Civil War, the original Sears, Roebuck & Co. developed a catalog business that sold the latest dresses, toys, build-it-yourself houses and even tombstones.

The company was, in many ways, an early version of Amazon.

Sears, which more than a century ago pioneered the strategy of selling everything to everyone, filed for bankruptcy protection early on Monday.

The company had long ago given up its mantle as a retail innovator. It was overtaken first by big box retailers like Walmart and Home Depot and then, by Amazon as the go-to shopping destinations for clothing, tools and appliances.

In the last decade, Sears had been run by a hedge fund manager, Edward S. Lampert, who sold off many of the company’s

valuable properties and brands but failed to develop a winning strategy to entice consumers who increasingly shopped online.

The result has been a long painful decline. A decade ago, the company employed 302,000. Today, there are about 68,000 people working at Sears and Kmart, which Mr. Lampert also runs.

Now, the retailer is aiming to use a Chapter 11 bankruptcy filing in federal court in New York to cut its debts and keep operating at least through the holidays.

As part of the reorganization plan, Sears has negotiated a $300 million loan from Wall Street lenders to help keep its shelves stocked and employees paid.

The company said it was still negotiating with Mr. Lampert’s hedge fund, ESL Investments, for an additional $300 million loan. Mr. Lampert will step down as Sears chief executive, but will remain the company’s chairman. Three other Sears executives will serve in a newly created role, the office of the C.E.O., overseeing daily operations.

“ESL invested time and money in Sears because we believe the company has a future,” Mr. Lampert said in a statement on Monday.

The company — which listed $11.3 billion in liabilities and $7 billion in assets — is also planning to close 142 more stores as it tries to reduce costs and find some way forward.

“It’s a sad day for American retail,” said Craig Johnson, president of Customer Growth Partners, a retail research and consulting firm. “There are generations of people who grew up on Sears and now it’s not relevant. When you are in the retail business, it’s all about newness. But Sears stopped innovating.”

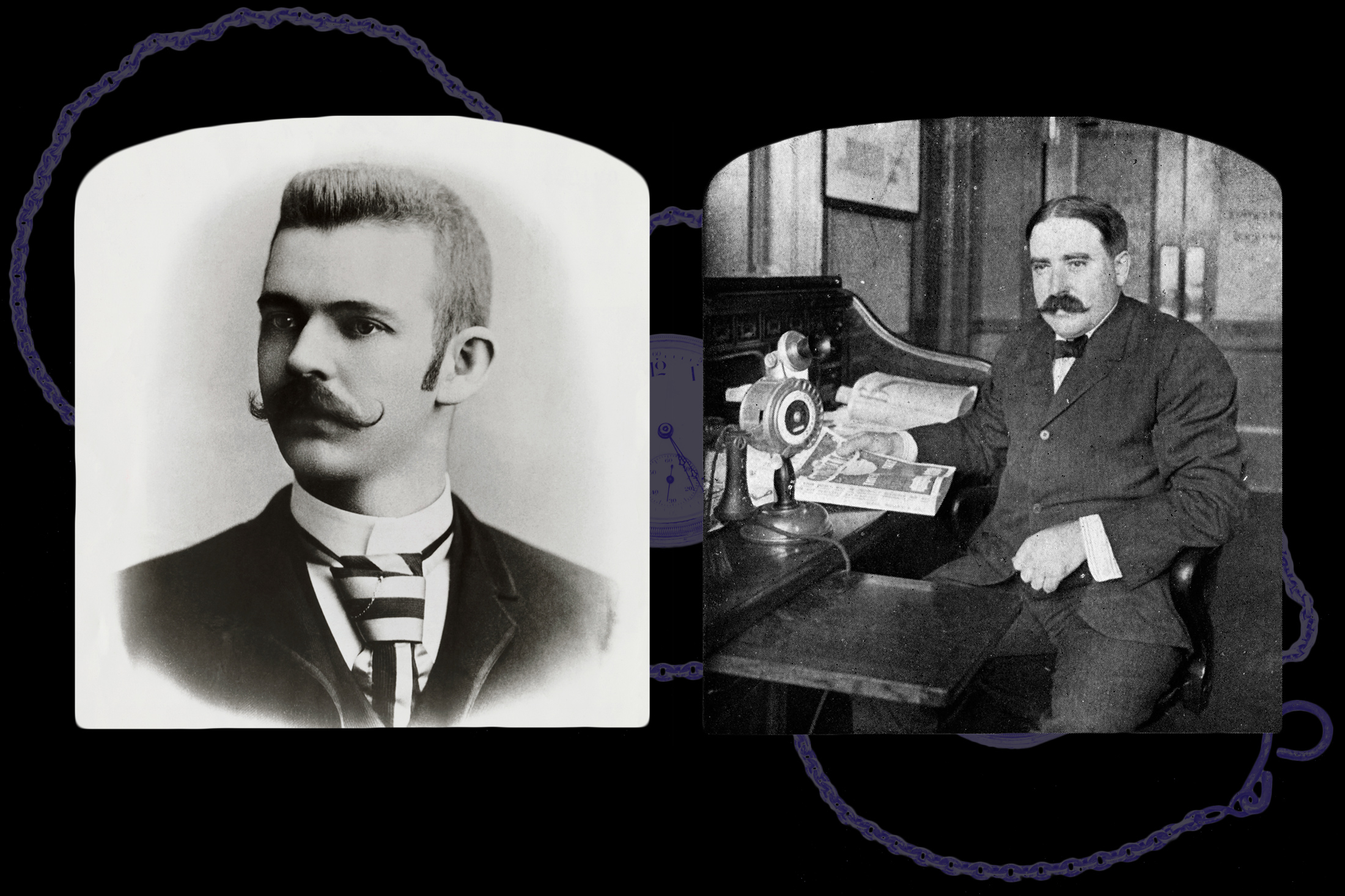

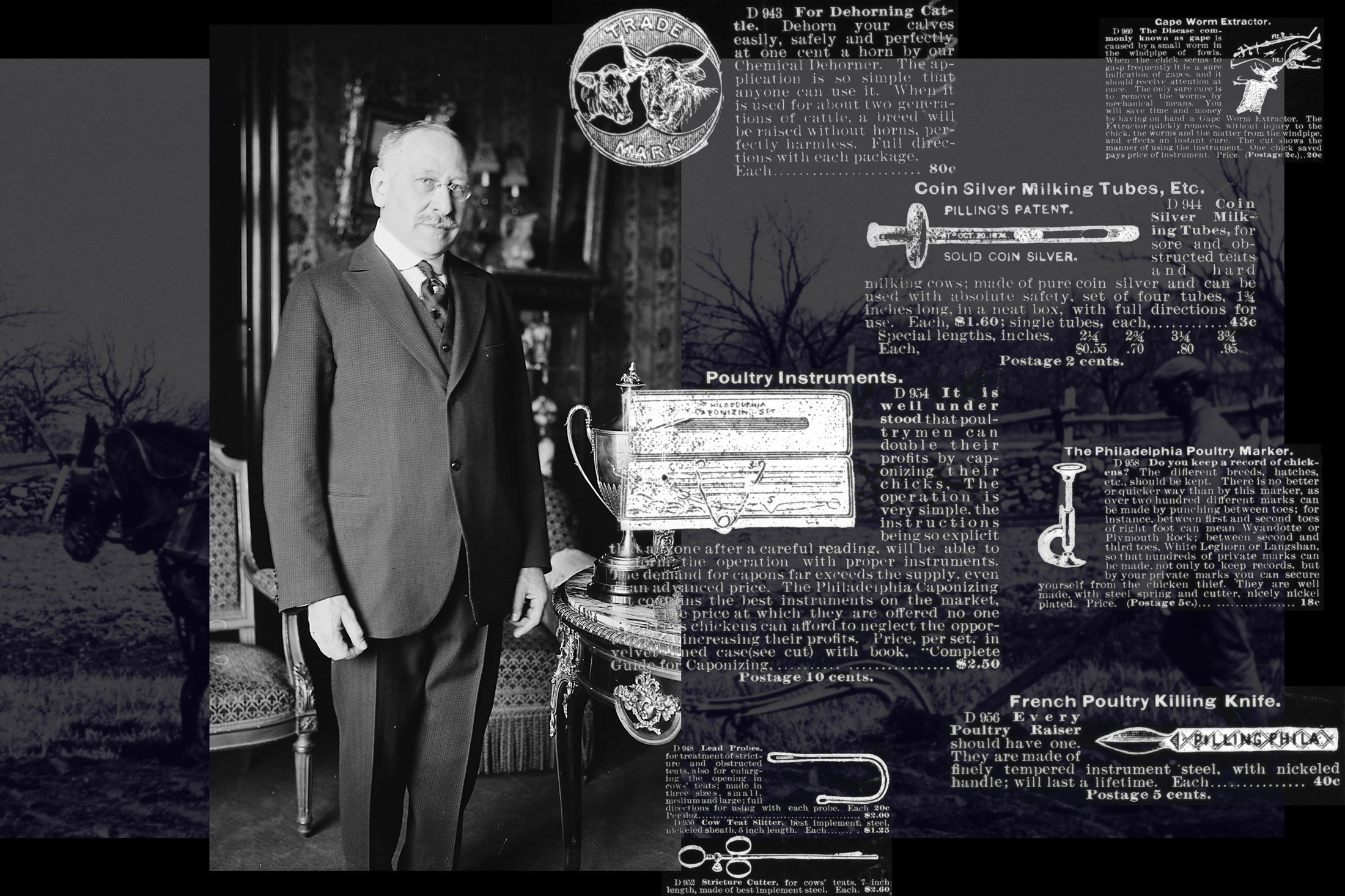

Founded shortly after the Civil War, the original Sears, Roebuck & Company built a catalog business that sold Americans the latest dresses, toys, build-it-yourself houses and even tombstones. In their heyday, the company’s stores, which began to spread across the country in the early 20th century, were showcases for must-have washing machines, snow tires and furniture.

More recently, Sears became known for another distinction — Mr. Lampert’s audacious feats of financial engineering. He has spun off numerous assets from the retailer into separate companies that his hedge fund invests in.

While many of these spinoffs have flourished, Sears slid toward insolvency.

Over the last five years, the company lost about $5.8 billion, and over the past decade, it shut more than a thousand stores.

Many of the 700 stores that remain have frequent clearance sales, empty shelves and handwritten signs.

Sears stores remain the centerpiece of hundreds of shopping centers across the United States and their decline has reduced traffic to many of those malls.

Running low on cash, the company had a $134 million debt payment due on Monday. Its total bank and bond debt stood at about

$5.6 billion in late September.

Reorganizing Sears will not be easy. The company’s e-commerce business has only a tiny fraction of the sales of Amazon, one of the world’s most valuable companies. And bringing back customers to Sears stores will take investment that Sears probably cannot afford.

The rise of e-commerce has contributed recently to a record number of stores closings and retail bankruptcies, including Sports Authority, Payless Shoes and Toys “R” Us. Like Sears, Toys “R” Us had tried to reorganize, but the

company eventually shut down and laid off all of its employees in June when its lenders concluded that the business was no long viable.

Although Sears lost its competitive edge long ago, its bankruptcy still represents a significant moment for its industry. No other large retailer has endured as long or played as important a role in American life as Sears.

The company started out selling watches to railroad agents in 1886 and soon expanded into a vast mail order business that sold clothing, tools, shoes, at one point

even cocaine and opium, through catalogs that ran as long as 1,000 pages.

Sears Roebuck was, in many ways, an early version of Amazon. It used the Postal Service to reach the most remote parts of a growing nation and sorted and shipped products from a three million-square-foot warehouse in Chicago.

After World War II, Sears stores served the needs of the country’s expanding middle class. Families came to have their children’s’ portraits taken, to get their tires rotated and oil changed, and to buy Kenmore refrigerators.

“Sears is where you went to shop,” said Barbara E. Kahn, a retail expert and marketing professor at the University of Pennsylvania’s Wharton School. “They sold fundamental products that consumers needed.”

Through the 1960s and 1970s, Sears shared its success with employees at all levels of its corporate hierarchy. Cashiers, janitors and executives alike took part in profit-sharing and received options in the company’s soaring stock.

As many as 100,000 retired Sears employees still receive pensions, which are expected to emerge largely unscathed in the bankruptcy. As the company was bleeding cash and selling off assets in recent years, federal regulators required Mr. Lampert to inject cash into the pension plan. Other benefits for retirees like life insurance, however, could be in danger.

“It is sad to see the company you really loved go down the tubes,” said Ron Olbrysh, 77, who worked in Sears’ legal department for 24 years and now heads an association of retired workers.

By the 1990s, Sears was struggling to find its place. Walmart was plopping its super centers across the United States. Home Depot was taking away market share on appliances and power tools, but Sears had valuable brands like Kenmore, DieHard and Lands’ End, and stores in prime locations.

Things changed dramatically when Mr. Lampert arrived on the scene.

A hedge fund manager, who got his start at Goldman Sachs and had little experience running a large retail chain, Mr. Lampert took control of Kmart after it came out of bankruptcy in 2003 and then acquired Sears a year later. The company’s board came to be dominated by other wealthy investors, including Steven Mnuchin, the current Treasury secretary who had been Mr. Lampert’s roommate at Yale.

Mr. Lampert says his strategy was to move the company away from its brick-and-mortar legacy into the digital era.

His plan was to use the money saved from closing stores and selling off assets to reinvest in the business. But the company never gained traction online.

The company’s decline has also exacted a toll on its workers. Peggy Mitchell, 55, who works full time unloading delivery trucks at the Sears in Chicago Ridge, Ill., said she barely makes enough to make ends meet.

Ms. Mitchell, who has four children, earns $10.75 an hour and cannot afford the company’s health plan. “Walmart pays more than that,” she said.

Sears remains a publicly traded company, but Mr. Lampert exerts an enormous amount of control.

He orchestrated a series of deals that generated cash for Sears in the near term, but stripped out many of the company’s most valuable assets — often selling them to companies that he also has a stake in.

Sears’ shares, which topped $120 as recently as 2007, closed on Friday at 40.7 cents.

Sears spun off Lands’ End, the preppy clothing brand, into a separate company, which Mr. Lampert’s hedge fund took a large stake in. Lands’ End market value now dwarfs that of Sears.

In 2015, Sears sold off stores worth $2.7 billion to a real estate company called Seritage. Mr. Lampert is a big investor in that company as well as its chairman. Seritage is converting many of the best locations into luxury offices, restaurants and apartments.

Mr. Lampert is also seeking to buy the Kenmore brand from Sears for $400 million.

Even in bankruptcy, Mr. Lampert will have great sway over the company’s fate. His hedge fund owns about 40 percent of the company’s debt, including about $1.1 billion in loans secured by Sears and Kmart properties. As a result, he could force Sears to sell the stores or transfer them to him to repay that debt.

“Lampert will make out,” said Mr. Olbrysh, the retired Sears worker. “There is no question about that.”

https://www.nytimes.com/2018/10/14/business/sears-bankruptcy-filing-chapter-11.html