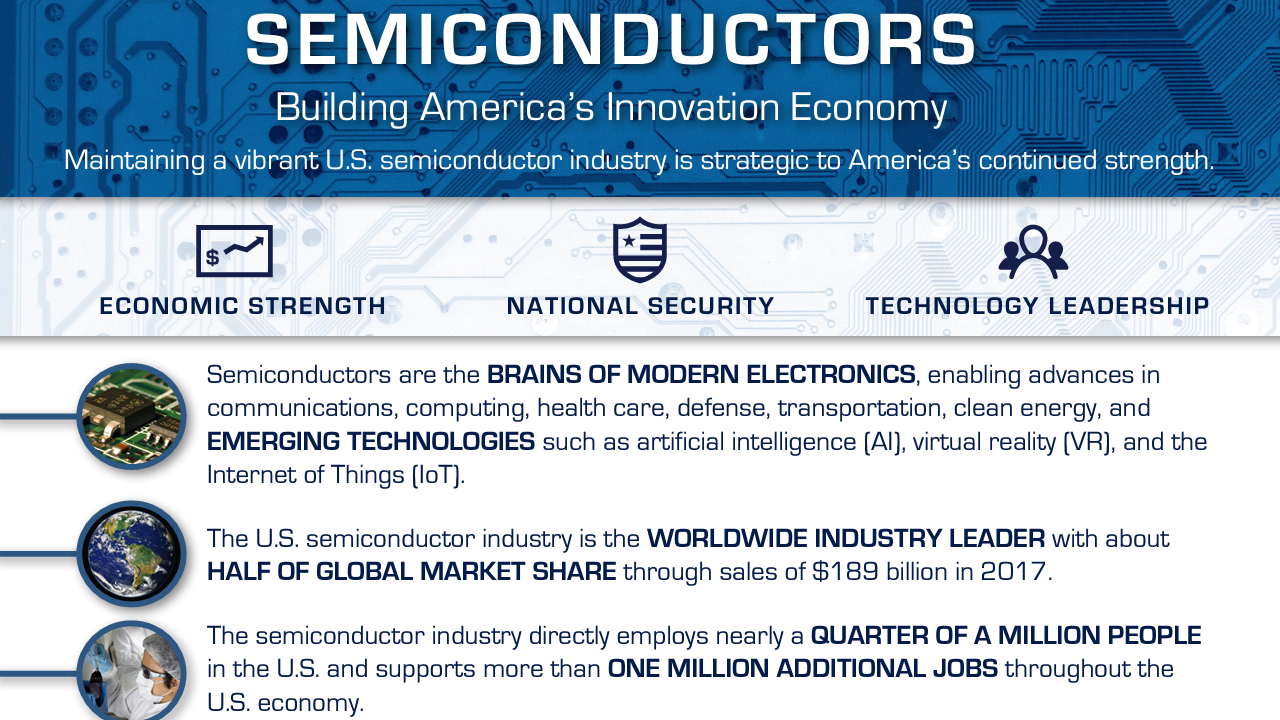

The export controls and foreign investment restrictions are mostly to do with the semiconductor industry (and to a lesser extent, aerospace) which is under relentless attack through cybertheft and industrial espionage. It has always maintained the majority of its production stateside, less than 3% of all US headquartered semiconductor firm fabrication manufacturing is in China.

For example, an IDM like Intel - which holds over 90% of both the global pc and data server microprocessor markets - has built currently operating US factories in 1996, 2001, 2002, 2003, 2007, 2013 and 2017 with a recent $7 billion capital investment for another in 2021 (the third in my metro area alone). I'm not sure how much regulations really matter when you construct LEED certified facilities that recycle over 90% of their solid waste. The same trend holds for a global leader in the analog semiconductor segment such as Texas Instruments.

The biggest reason it ever goes anywhere is because a lot of companies - Qualcomm, AMD, Nvidia, Marvell - are fabless which allows them more breathing room to focus strictly on IC design engineering and the biggest pure play foundries (no in-house design capabilities) are in geopolitically friendly countries such as Taiwan and Singapore.

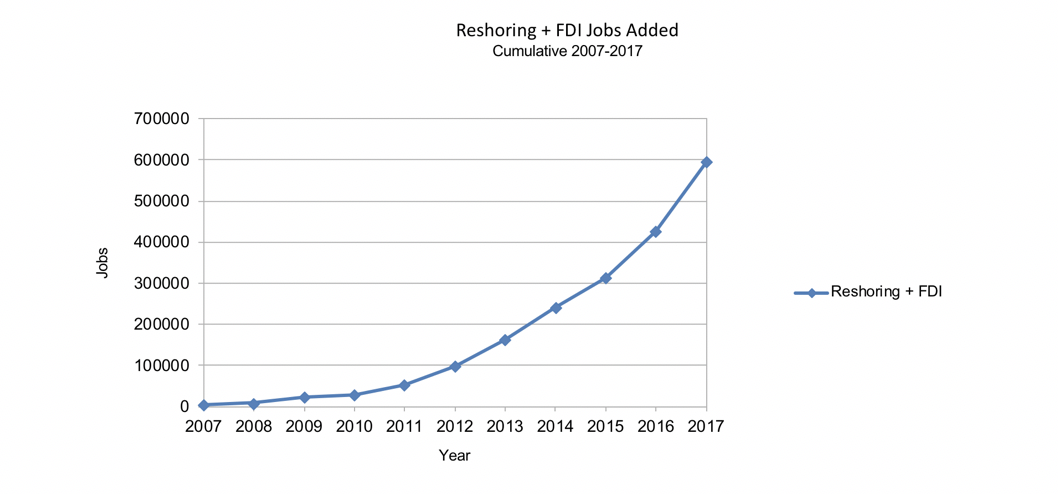

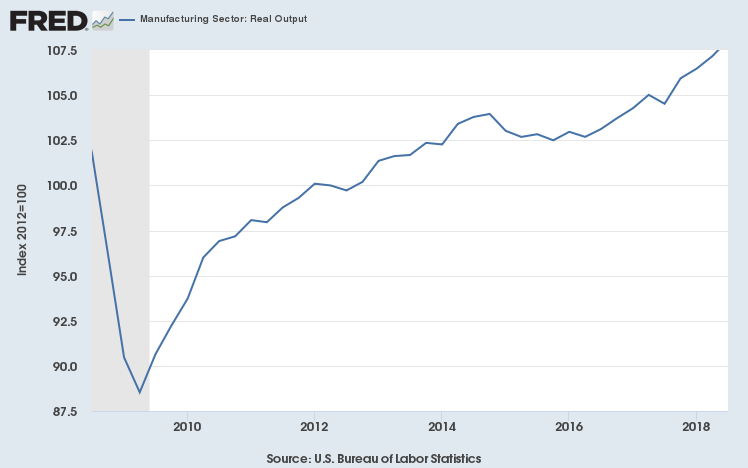

As far as 'production' on the whole, Industry 4.0 is being driven by a massive volume of available data, developments in analytics and machine learning, new forms of human-machine interaction and the ability to transmit digital instructions to the physical world but it also uses predictive capabilities to generate value and create more efficient logistics to handle materials throughout the supply chain. It's actually creating more jobs than are being eliminated, more jobs than we'll likely even be able to fill over the next 10 years.

Why devalue your currency and force pay cuts when you can just develop technologies and innovate new processes that lower the total cost of production instead? Haha, because that's extremely difficult and requires real ingenuity but it's kind of what the fuck 'Murica does.

Cheap slut bitch cunts.