- Joined

- Jan 9, 2017

- Messages

- 9,848

- Reaction score

- 8,568

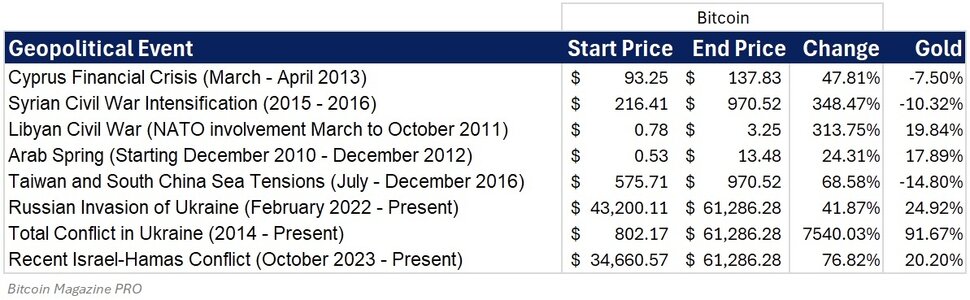

I'd Bridge it all to native. Just to avoid the slim chance you send the wrong token on the future. If it's all native matic it's less confusing.Don't know how or why it took me this long to notice this, but I just realized almost half my MATIC is ERC-20 and the other half Polygon.

Requesting opinions, should I convert the ERC-20 half to Polygon or just leave it as is?

Pros, cons?

You can bridge from erc20 to native via the official polygon bridge.if its in your personal wallet, you will need to send it to an exchange before you can move them to another chain.

Polygon Portal

Polygon Portal helps you bridge your assets on the Polygon PoS, Polygon zkEVM and Ethereum chains, so you get onboarded to the Polygon ecosystem seamlessly.

wallet.polygon.technology