- Joined

- Dec 6, 2010

- Messages

- 33,424

- Reaction score

- 5,686

Yeah this does not surprise me at all.

At least with the other municipal BKs you could argue that the investors knew the risks and so does the municipalities. The repricing of debt is a normal reaction to risk resulting from the cities behavior. But with PR when people advocate just making up the rules as they go, well it adds a new level of risk pricing that has to go into the mix. You know have to factor in how you are going to be treated or how even someone who you sell the debt to, will be treated, into pricing.

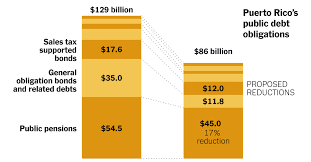

The oversight board just presented their idea: completely ignore the fact that the Puerto Rican constitution mandated that General Obligation bonds must be paid first, and give PR public pension fund first priority instead. Bondholders gets a massive 66% haircut, while pension fund only get a 17% reduction.

We can safely consider any constitutional-guaranteed General Obligation bond that Puerto Rico try to sells in the future to have the same appeal as toxic waste now.

$129 Billion Puerto Rico Bankruptcy Plan Could Be Model for States

By Mary Williams Walsh and Karl Russell | Sept. 27, 2019

By Mary Williams Walsh and Karl Russell | Sept. 27, 2019

After years of wrangling with its creditors, Puerto Rico disclosed a plan Friday for resolving the biggest governmental bankruptcy in United States history, by cutting $129 billion in debts to about $86 billion — a reduction of 33 percent.

The plan hatched by a seven-member federal oversight board is now before a federal judge, who will decide any disputes. There are sure to be plenty — the various parties are tangled in an unprecedented financial collapse. Puerto Rico’s inability to pay its debts required Congress to create a new law, called Promesa, that allowed a territory to essentially seek bankruptcy protection.

If the plan survives the challenges ahead, it could be a model for how struggling states deal with their financial problems in the future. Illinois, New Jersey and others are weighed down by heavy debts, particularly their pension obligations. But like Puerto Rico before Promesa, states cannot declare bankruptcy — it would require congressional action to extend a version of that framework to them.

The efforts to make Puerto Rico solvent have been complicated, requiring novel maneuvers by the oversight board that must garner the support of enough stakeholders to move forward.

Those parties, which include bondholders, pensioners, current government employees and others, will have a chance to vote on the deal they’re offered, and so far support has been mixed. Some bondholders have supported the plan, while others have signaled a willingness to fight it out in court. The island’s teachers rejected the plan in a preliminary vote, but 167,000 government retirees haven’t yet been polled.

Puerto Rico’s plan makes certain bondholders seem like the big losers. It would trim the island’s bond obligations to $41 billion from $75 billion — a 45 percent reduction. But that’s just an average. Under the surface, some bondholders will get 64 cents on the dollar, while others will get just 35 percent. A lucky few — those holding a certain type of sales tax-supported bond — come out with 93 cents on the dollar. Others could risk getting nothing at all.

The new plan may look like it’s wiping out billions in debt overnight, but in reality, a lot of the losses have been sustained already. The bonds have been actively traded since they were issued, and the territory’s steadily worsening financial situation pushed their value down over the years. Their prices bottomed out after Hurricane Maria two years ago.

For an investor who bought, say, a 30-year general obligation bond when it was issued in 2009, then held it until now, the new debt plan spells a 36 percent loss. He might be kicking himself for not selling back in 2012, when he could have come close to breaking even. In Puerto Rico, these bonds carry a constitutional guarantee and were supposed to be bulletproof.

But an investor who bought the same bond amid the devastation of Hurricane Maria, when nearly everybody else was selling, would have paid around 20 percent of the face value. From his perspective, the new debt plan more than triples his money.

To nudge some disappointed investors into supporting the plan, the oversight board is playing something of a game of chicken with those who bought Puerto Rico’s most recent vintages of general obligation bonds, issued in 2012 and 2014.

The board has said it believes the newer bonds should never have been issued because they took the island over its legal debt limit. The new plan offers investors who hold them settlements well below the 64 cents on the dollar the other bondholders are getting. If they don’t like it, they can sue, and try to convince the federal judge overseeing the case, Laura Taylor Swain, that their bonds are valid. If they win, they would get 64 cents on the dollar like everyone else. If they lose, they would get nothing — and the money set aside for them would be given instead to the investors already getting 64 cents.

Other legal challenges await the plan from bondholders who believe the board was far too generous to Puerto Rico’s retired government workers.

Over the years, the government of Puerto Rico, seeing the huge problem the unfunded pension obligations presented, made some moves to limit the damage. In 2013, it forced new hires into a defined contribution plan, similar to a 401(k). A few years later, it forced all current employees, regardless of hire date, into such a plan.

Those moves did reduce the island’s pension obligations, but not enough to save the system from collapse. The new restructuring plan would cut the island’s $54.5 billion pension obligation to $45 billion, this time affecting even retirees. Their pension would be cut on a sliding scale: The biggest pensions would be reduced by, at most, 8.5 percent, and the smallest pensions would not be cut at all.

That will be a big complaint of general obligation bondholders, who cite the constitutional provision putting them at the front of the line to be paid.

Puerto Rico’s retirees, on the other hand, would normally be at the back. That’s because the island’s pension fund is completely empty after being used for years as a source of money to pay the government’s expenses. An empty pension fund would ordinarily make the retirees unsecured creditors entitled to almost nothing.

But the retirees make up such a large share of the island’s economy that leaving them in the lurch might chill efforts to rekindle economic growth.

So the federal board leaned on language in Promesa to improve the retirees’ legal standing. That language, not present elsewhere in American bankruptcy law, requires Puerto Rico to “provide adequate funding for public pension systems.” The board also persuaded the island’s lawmakers to dismantle the empty pension fund and in the future make each year’s pension benefits a mandatory outlay of the budget.

The result is retirees get a better deal than almost any other creditor group: at least 91.5 cents on the dollar.

Natalie Jaresko, the board’s executive director, said the board’s main goal was reducing Puerto Rico’s debts to a level its economy could sustain. That has been a two-step process.

First, the board looked at the debt burdens of America’s 10 most indebted states, calculated the average, and pared back Puerto Rico’s debt to an amount less than that. Then it began pushing for changes meant to make the government perform more efficiently, rebuild the public trust and encourage businesses to grow and hire. To make it all work, consumers on the island need to be able to spend money — including Puerto Rico’s pensioners.

“Sustainability is not a requirement of the law, but we really wanted it to be at the center of everything we did,” Ms. Jaresko said. “We weren’t going to end up in a situation where 10 years from now, 12 years from now, Puerto Rico would have to restructure again.”

https://www.nytimes.com/2019/09/27/business/puerto-rico-bankruptcy-promesa.html

Last edited: