Puerto Rico Asks Judge to Force Federal Board to Share Its Power

By

Steven Church | July 25, 2018

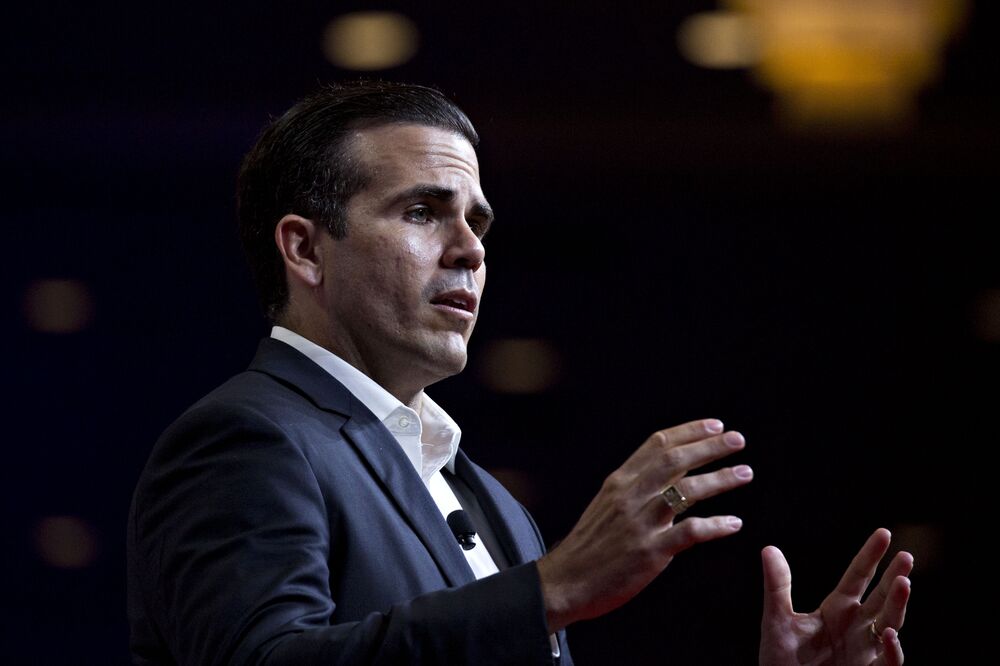

Puerto Rico Governor Ricardo Rossello is seeking to wrest back some of the budgetary authority that was ceded to the fiscal oversight board established by Congress to impose fiscal discipline on the bankrupt island and help pull it out of a long-running debt crisis.

The attorneys for the territory made their plea during final arguments in federal court in San Juan on Constitution Day, a state holiday celebrating Puerto Rico’s constitution. The case has pit elected officials who have lost the power of the government’s purse against a panel of appointed technocrats who have demanded unpopular economic changes.

Each side said the future of the island was at stake, with lawmakers arguing that democratic ideals require more local influence and the board claiming that fiscal disaster looms without painful reforms, like watering down labor laws to encourage businesses to hire and reducing the number of government jobs.

A U.S. law that set up the fiscal board “does not make the board the supreme ruler of Puerto Rico,” Claudio Aliff-Ortiz, a lawyer for the commonwealth’s general assembly said in court. “It does not make the board king of Puerto Rico.”

The case began earlier this month after the Financial Oversight and Management Board for Puerto Rico imposed its own fiscal plan and budget on the commonwealth, prompting Rossello and the legislature to file lawsuits seeking to give them more say in the process.

U.S. District Court Judge Laura Taylor Swain said after Wednesday’s hearing that she would try to quickly rule on the board’s request to dismiss the lawsuits.

Much of Puerto Rico’s closing argument focused on the board’s demand that the legislature repeal a local law, known as Act 80, that protects workers’ jobs. Lawmakers agreed to remove the protections for future workers, but not existing employees.

That demand was necessary to convince investors to return to the island, the board’s lead attorney Martin Bienenstock told Swain.

Congress gave the board control over the territory’s budget and the related, implementing legislation, Bienenstock said. Giving the governor the right to redirect spending would undermine the point of the law, known as Promesa.

But Rossello’s lead attorney, Peter Friedman, argued that trimming the board’s authority does not conflict with Promesa. The board would still be able to impose painful consequences on the government, but only if Rossello spends more than the budget allows, he said.

Creditors are watching the fight closely because it could affect their willingness to accept a recently proposed compromise on how to divide the island’s sales-tax revenue, said Luc Despins, the lawyer for a court-approved committee for unsecured creditors. Last month two court appointed agents reached a deal on how to split billions in sales taxes, a key step forward in the bankruptcy case that triggered a rally in the price of Puerto Rico’s bonds.

Puerto Rico is locked in a battle with creditors after free spending, corruption and a decade-long recession that left it unable to keep paying its $74 billion of debt.

The unsettled question of the board’s power has been a defining theme of the island’s attempts to end its fiscal crisis. Last year, Rossello won a key court battle when Swain rejected the board’s attempt to take control of Puerto Rico’s troubled electric utility, known as Prepa.

Swain

said then that Congress had denied the board direct power over Puerto Rico’s government and made its job harder. Congress created a “power-sharing structure that allows for mutual sabotage,” Swain said.

The case is Ricardo Antonio Rossello Nevares V The Financial Oversight and Management Board for Puerto Rico, 18-00080, U.S. Bankruptcy Court, District of Puerto Rico (San Juan)